Repacks in 2021: Steadier Issuance – Lower Volatility

- Published

- in Analysis & Insights

Investors continue to be drawn to the repackaging (”repack”) market, which has been a key and highly flexible source of funding throughout the pandemic and during the subsequent period of market recovery. Leveraging on our strong client relationships in this highly specialised sector, the Maples Group recently conducted a market survey of the leading repack arrangers. In conjunction with an analysis of our proprietary data for the first half of 2021, the survey results provide significant insight into transaction trends and the issues currently uppermost in the mind of the major repack market participants.

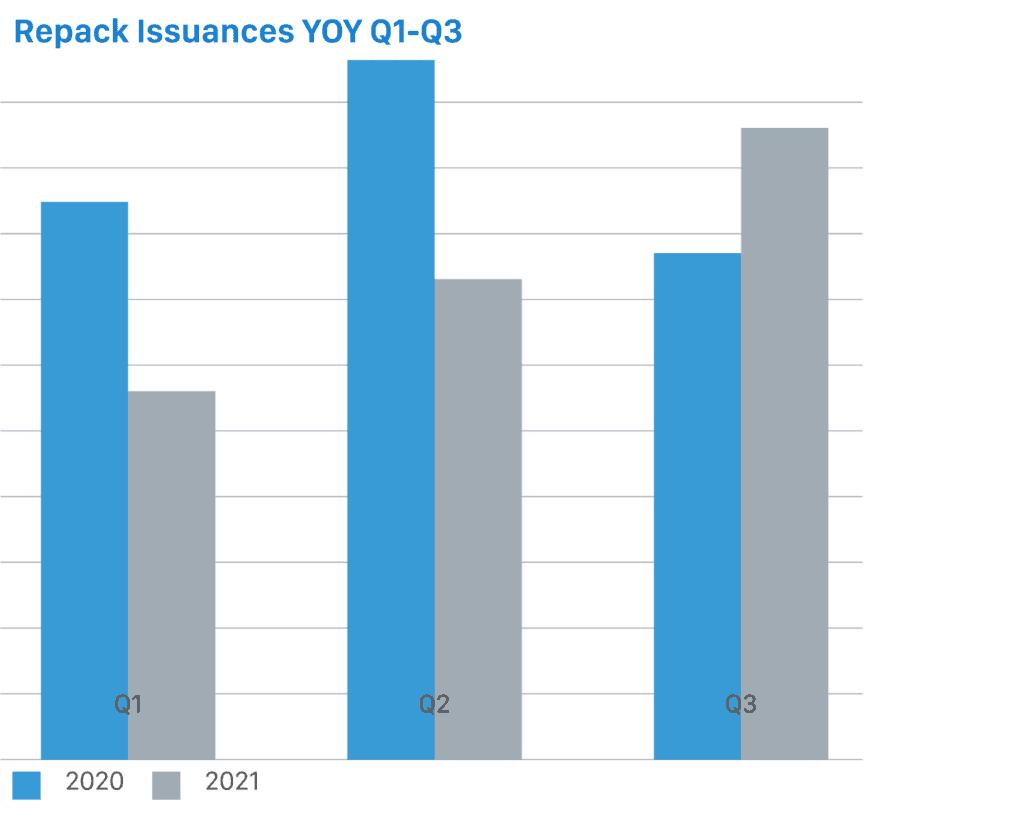

The amount of repack business the Maples Group has been involved in through the Cayman Islands this year is tracking somewhat behind the same period in 2020, but on par with 2019. The biggest difference to 2020 is in relation to the spike in issuances seen during the second quarter of last year. Issuances from April to June 2020 ran at almost double the average month for that year, with Cayman Islands repack business significantly ahead of the same period in 2019. The market gained momentum during the initial stages of the COVID-19 shutdown, highlighting the appeal of repacks during market stress, echoing the pattern during the 2007 – 2008 downturn.

The softer activity in the first half of 2021 chimes with the greater stability in global markets and the improving economic condition. While the industry continues to monitor developments, it appears likely the remainder of this year will continue in a similar vein to previous months. Given the current state of the market, with steadier issuance levels and fewer volatile swings, what are arrangers thinking about?

Arranger Focus

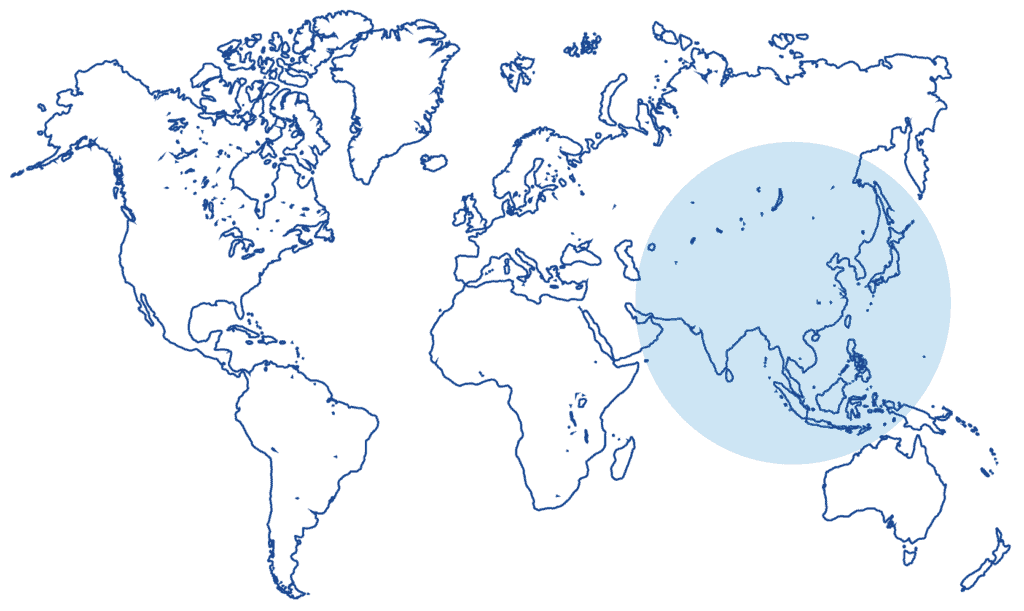

The continued focus on repacks is evident amongst the key arrangers, who in their responses to our survey, note that repack programmes are ranked with high importance within their current offering. A majority of respondents also confirmed that their repack capabilities are being strengthened at this time, likely driven by opportunities in the market amidst robust investor demand. From a jurisdictional standpoint, Asia remains a key region of focus, both from an asset sourcing perspective but also as a location for investors. More specifically, China, Japan, Singapore and South Korea continue to be the most popular jurisdictions for repack programme issuance and a high concentration of investors.

Regulatory Challenges Persist

Our clients in the repack space continue to highlight regulatory challenges on the horizon. Of particular note is the lack of a harmonised regulatory framework in Europe, with the risk that issuances may be re-characterised as Alternative Investment Funds (AIFs) in certain jurisdictions. That could leave issuers subject to a new level of complex regulation the deals were not structured for. The industry is also working to address the potential impact of the EU Anti-Tax Avoidance Directives (ATAD I & II “ATAD”), especially as individual EU member states work to implement the rules in their home jurisdictions.

With regard to LIBOR and the phasing out of the benchmark this year, divergent views were apparent from arrangers. Some of those surveyed said that LIBOR is the single biggest concern facing their business, confirming they are prepared for the transition, having conducted remediation work, including requesting investor consent and amending legacy transactions. Other survey respondents stated that their firm has made preparations and they felt the LIBOR discontinuation has introduced significant uncertainty into the market.

Additional regulatory attention is focused on sanction regimes, AML compliance and tax issues which present ongoing challenges. Overall, while arrangers continue to work to accommodate the new regulations, most believe they will not have to fundamentally rethink their structures.

ESG

While ESG continues to dominate discussion in the investment fund space, Environmental, Social and Governance factors do not at the moment appear to be of great concern or carry any significant influence for arrangers when planning a repack structure. Most arrangers surveyed, however, do expect that to change significantly over the next five to ten years, so this remains an area to watch closely as investors continue to drive the ESG agenda across the financial sector.

Products

Examining the product mix, surveyed arrangers cited the attractiveness of bond repacks with callable asset swaps, which are felt to be more interesting given the current low interest rate environment. The increased flexibility from callable swaps can be attractive in perhaps more volatile economic conditions. Typically the repack programme market leans towards a traditional note issuance vehicle, while the use of credit linked notes has been a more recent trend.

As the global economic recovery continues, the threat of inflation persists and this was one particular concern raised by arranging banks in our survey. While, the risk of inflation was cited by some respondents as a potential concern, others however said that inflation potentially brings other product opportunities into the picture.

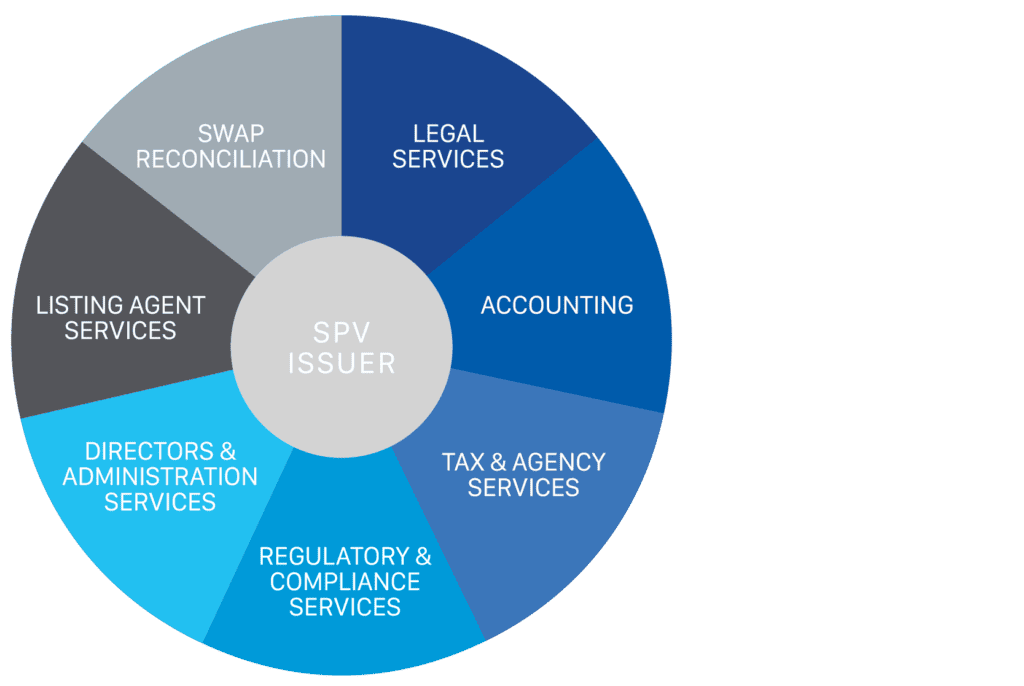

As a major player in the global securitisation market, the Maples Group supports arranging banks and financial institutions globally, both in a fiduciary capacity and in regard to Cayman Islands, Irish, Luxembourg and Jersey law. Depending upon investor requirements, repack programs are arranged using vehicles in these jurisdictions.

Our group’s specialised knowledge in this area continues to evolve and meet the requirements of repack market participants. With this expertise and a presence in the key repack jurisdictions, we provide a range of fiduciary services, ensuring the SPV remains current and compliant with all legal and regulatory matters. In addition to providing independent Cayman Islands, Luxembourg, Ireland or Jersey-based directors, depending on the domicile, the Maples Group offers entity registered office services and AML compliance services alongside other regulatory solutions.